Understanding your insurance coverage for Invisalign requires checking orthodontic benefits, medical necessity criteria, and provider networks. Most dental insurance covers 25% to 50% of Invisalign costs with lifetime maximums between $1,000 and $3,000.

Adults often face more coverage limitations than children, making benefit verification essential before treatment. Working with experienced providers and using financial planning tools can help maximize coverage and manage costs.

Getting straighter teeth with Invisalign is an exciting journey, but figuring out insurance coverage can feel like solving a puzzle. Dr. Blaine Leeds at Tiburon Family Dental in Tiburon, California understands these challenges. As a renowned expert in clear aligner orthodontics and having owned multiple practices, he’s helped countless families navigate the insurance maze to achieve beautiful smiles.

Dr. Leeds brings unique expertise to Invisalign treatment, combining his knowledge as a national leader in orthodontics with a compassionate approach to patient care. His experience with telehealth and comprehensive dental treatments means he can guide you through both the clinical and financial aspects of your Invisalign journey.

Understanding insurance coverage for Invisalign starts with knowing that every insurance plan is different. What works for your neighbor might not work for you, which is why Dr. Leeds and his team take time to review each patient’s specific coverage and create personalized treatment plans that work within their budget.

Securing Insurance Coverage for Invisalign Treatment

Successfully obtaining insurance coverage for Invisalign requires understanding three critical elements that insurance companies evaluate: orthodontic benefits scope, medical necessity criteria, and provider network status. Addressing these factors proactively can significantly improve your chances of coverage approval.

Understanding your orthodontic benefits is the foundation of predicting insurance coverage. Many patients don’t realize their dental insurance may include a separate section for orthodontic procedures with distinct terms and limits. It’s essential to review your policy carefully or speak with your insurance representative to understand the full extent of your orthodontic coverage.

Medical necessity criteria determine whether insurance will view your Invisalign treatment as essential healthcare or cosmetic improvement. Insurance companies typically require detailed documentation from dental professionals explaining why Invisalign is the best treatment option and not merely for appearance. Significant alignment issues affecting your bite or oral hygiene often satisfy medical necessity requirements.

Choosing an in-network provider can dramatically impact your out-of-pocket costs. Insurance companies negotiate preferential rates with network providers, meaning patients who select in-network Invisalign providers often benefit from reduced expenses. Before choosing Dr. Leeds or any provider, verifying their network status can save you considerable money.

Age restrictions often apply to orthodontic coverage, with many plans limiting benefits to patients under certain ages. Understanding these limitations helps set realistic expectations about coverage availability.

Understanding Invisalign Insurance Coverage

Navigating Invisalign insurance coverage requires focusing on three key areas: understanding coverage limits, examining policy details, and preparing proper documentation for medical necessity approval.

Coverage limits typically allow insurance plans to pay only a fraction of total Invisalign costs, usually between 25% and 50%. Equally important is the lifetime maximum benefit, which generally ranges from $1,000 to $3,000 and represents the total amount your insurer will ever pay for orthodontic treatment. Knowing these figures helps you anticipate out-of-pocket expenses accurately.

Policy details require careful examination to understand your coverage fully. This includes analyzing your deductible, which is the amount you pay before insurance kicks in, plus any waiting periods or co-payments that might apply. Identifying these details early prevents unexpected costs and enables better budgeting for orthodontic treatment.

- Review your specific orthodontic benefits and lifetime maximums

- Understand deductibles, co-payments, and waiting periods

- Gather comprehensive dental health records for documentation

- Work with your orthodontist to establish medical necessity

- Verify provider network status before beginning treatment

Medical necessity documentation is essential for securing insurance coverage for Invisalign. Insurers need evidence that treatment addresses dental health requirements rather than cosmetic preferences. Patients should gather comprehensive dental health records and work with Dr. Leeds to provide solid rationale for treatment, increasing the likelihood of coverage approval.

Insurance Myths and Facts for Adult Coverage

Adults considering Invisalign should understand three key aspects of insurance coverage: differences between adult and dependent coverage, the importance of pre-treatment benefit verification, and the need for realistic expectations about coverage limitations.

Coverage distinctions between adults and dependents are significant in orthodontic insurance. Adult coverage typically presents more limitations than coverage available to individuals under 19 years old. Age-specific coverage caps or exclusions may apply, making it essential for adults to thoroughly examine their policy terms to understand their full entitlements.

Pre-treatment benefit verification is not just a formality but a critical preparation step. Adults should obtain detailed breakdowns of their orthodontic benefits, including deductibles, co-payments, and covered percentages specific to Invisalign. This prevents misunderstandings that could affect treatment progress and financial planning.

Realistic expectations about insurance coverage help avoid frustration and financial strain. By verifying benefits and understanding the insurance landscape beforehand, patients can approach their orthodontic journey with clear understanding of potential out-of-pocket costs, ensuring they’re not surprised by insurance shortfalls after treatment begins.

Many adults assume they have no orthodontic coverage simply because they’re over 18. However, many employer-sponsored plans do include adult orthodontic benefits, though often with different terms than pediatric coverage.

Navigating Orthodontic versus General Dental Coverage

Understanding the differences between orthodontic and general dental coverage is crucial for evaluating Invisalign insurance options. This involves recognizing coverage separation, understanding approval protocols, and analyzing specific orthodontic requirements within your plan.

Coverage separation is fundamental to understand because dental insurance plans often divide benefits into different categories for general and orthodontic care. While routine dental checkups might be covered under general benefits, Invisalign as an orthodontic treatment falls under completely different rules and coverage structures.

Approval protocols for orthodontic treatment often require separate deductibles and involve maximum benefits distinct from general dental services. These terms determine how much patients pay out-of-pocket for Invisalign before insurance coverage begins. Higher orthodontic deductibles can mean considerable initial expenses before insurance takes effect.

Orthodontic stipulations vary significantly between insurers, with different requirements and limits for eligible procedures. Patients should closely review their plans to determine if Invisalign qualifies for coverage and understand the potential extent of that coverage, which may range from partial to full depending on plan structure.

Some plans require pre-authorization for orthodontic treatment, meaning you need approval before beginning Invisalign. Understanding these requirements prevents delays and ensures smooth treatment progression.

Strategies for Maximizing Invisalign Coverage

Enhancing your likelihood of Invisalign coverage involves collaborating with dental billing experts, utilizing financial planning tools, and conducting thorough insurance policy analysis to uncover all available benefits.

Dental billing experts possess specialized knowledge in orthodontic insurance processes and can guide patients through claim filing complexities and coverage maximization strategies. Their expertise proves invaluable when navigating nuanced orthodontic insurance conditions that often complicate securing coverage for treatments like Invisalign.

Financial planning tools provide additional support for managing Invisalign costs. Tax-advantaged accounts such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) offer strategic ways to reduce treatment expenses. Setting aside pre-tax dollars effectively reduces the net cost of Invisalign treatment, particularly helpful when insurance covers only partial expenses or high deductibles apply.

Meticulous insurance policy review can uncover opportunities for greater coverage. Patients should invest time comprehensively examining their insurance plans to understand all terms and conditions related to orthodontic benefits. This includes checking for specific exclusions, limitations, and required processes for submitting Invisalign claims.

Working with experienced providers like Dr. Leeds at Tiburon Family Dental can also maximize coverage opportunities. His expertise in clear aligner orthodontics and insurance navigation helps patients understand their options and make informed decisions about treatment timing and approach.

When to Escalate Insurance Concerns

Effectively managing Invisalign treatment requires knowing when to escalate insurance concerns based on structural benefits assessment, medical necessity documentation quality, and provider network relationships that affect coverage.

Structural benefits evaluation is the first critical step in determining coverage eligibility. Patients should verify their plan explicitly includes orthodontic benefits, as this determines fundamental Invisalign coverage qualification. Absent or insufficient benefits signal the need to consider additional coverage options or escalate matters with insurance providers.

Medical necessity documentation preparation requires thorough evidence that Invisalign addresses medical needs rather than cosmetic preferences. Strong documentation from dental professionals supporting the medical basis for Invisalign greatly influences coverage likelihood. Insufficient documentation may require challenging initial insurance decisions or exploring alternative funding methods.

Provider network relationship dynamics significantly impact out-of-pocket expenses. Patients often find reduced costs when using Invisalign providers with established insurance company agreements. Choosing out-of-network providers may require questioning coverage impact and exploring ways to mitigate additional costs.

Dr. Leeds’ experience as a national leader in clear aligner orthodontics provides valuable support when escalating insurance concerns. His expertise helps patients understand their options and advocate effectively for appropriate coverage.

Tiburon Family Dental’s Role in Invisalign Coverage

Dr. Blaine Leeds and Tiburon Family Dental play vital roles in guiding patients through Invisalign insurance complexities, offering local insights, specialized expertise, and customized financial solutions for the Northern California area.

Local insurance expertise helps patients navigate regional insurance plan intricacies specific to the Bay Area. This insight proves particularly valuable in California where insurance options may differ significantly from other states. Patients benefit from Dr. Leeds’ deep understanding of local policies, ensuring effective utilization of available insurance benefits for Invisalign treatments.

Specialized Invisalign guidance aligns patients’ orthodontic treatment needs with their insurance coverage possibilities. Dr. Leeds’ expertise as a renowned clear aligner specialist allows him to advise on the best treatment path considering both health outcomes and insurance implications. This individualized approach acknowledges that orthodontic health contributes to overall well-being while insurance support varies widely between cases.

Customized financial planning tailored to each patient’s insurance coverage and personal budget ensures accessibility regardless of coverage levels. Whether insurance provides full, partial, or no Invisalign coverage, Tiburon Family Dental works to prevent financial barriers from blocking necessary orthodontic care. This might include payment plans or alternative options making Invisalign treatment affordable for all patients.

Best Practices for Seeking Invisalign Insurance Coverage

Effective approaches to obtaining Invisalign insurance coverage involve maintaining detailed clinical records, seeking multiple expert opinions, and thoroughly understanding insurance policy specifics including appeals processes.

Detailed clinical documentation strengthens arguments for medical necessity of Invisalign treatment. Insurance providers assessing treatment claims typically examine pre-existing conditions, past dental interventions, and progressive issues requiring orthodontic care. Comprehensive records bolster insurance claim legitimacy and ensure all relevant health factors receive consideration during coverage determination.

Multiple expert opinions provide robust support for coverage applications. Different orthodontists may offer varying perspectives on treatment necessity and effectiveness, and integrating these professional insights provides comprehensive justification for insurance claims. This approach expands patient understanding while enhancing supporting evidence presented to insurance providers.

In-depth policy knowledge, including appeals process intricacies, empowers patients to navigate complex insurance claim territories effectively. Understanding coverage extent and limits, along with steps for challenging insurance decisions, enables proactive advocacy for orthodontic needs through clear, informed communications with insurance companies. Dr. Leeds’ experience and national recognition in clear aligner orthodontics provides valuable support throughout this process, helping patients build strong cases for coverage approval.

Making Invisalign Treatment Financially Manageable

Acquiring Invisalign at manageable costs requires meticulous investigation, strategic financial preparation, and leveraging professional guidance for navigating insurance coverage complexities successfully.

Comprehensive insurance coverage investigation equips patients with knowledge necessary to understand orthodontic treatment benefit breadth and limitations. Detailed exploration uncovers specifics like covered percentages, waiting periods, and exclusions directly influencing Invisalign affordability. This understanding forms the cornerstone of informed decision-making regarding orthodontic treatment paths.

Strategic financial planning represents another vital step toward managing Invisalign costs effectively. Partnering with experienced practices like Tiburon Family Dental allows patients to anticipate potential expenses and identify financing options synchronizing with personal budgets. Plans shaped around individual insurance scenarios can dramatically ease financial burdens while ensuring enhanced smile journeys remain achievable.

Professional expertise provides confident navigation through insurance complexities, helping identify cost-effective strategies for orthodontic needs. Dr. Blaine Leeds’ reputation as a clear aligner expert and his compassionate approach to patient care ensures comprehensive support throughout the insurance and treatment process. His co-authorship of “What Happens When Your Child Doesn’t Sleep?” demonstrates his commitment to patient education and comprehensive care. The combination of detailed insurance research, tailored financial strategizing, and expert collaboration makes Invisalign a realistic and achievable goal for patients throughout the Tiburon area and beyond.

Schedule your consultation today!

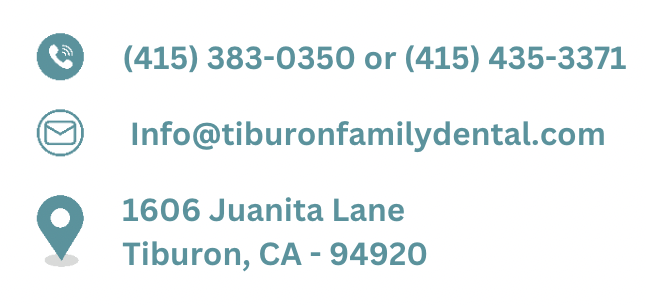

Tiburon Family Dental

1606 Juanita Lane

Tiburon, CA – 94920

(415) 383-0350

Frequently Asked Questions

Does my dental insurance cover Invisalign treatment?

Many dental insurance policies include Invisalign coverage under orthodontic benefits, but coverage varies significantly between plans. It’s essential to check your specific policy details for coverage limits, eligibility requirements, and any age restrictions that might apply to your situation.

What if my insurance doesn’t fully cover Invisalign costs?

If insurance doesn’t cover complete Invisalign costs, several options can help manage remaining expenses. These include flexible payment plans, Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and consulting with dental billing experts to maximize available benefits and explore financing alternatives.

How can I maximize my Invisalign insurance coverage?

To maximize coverage, thoroughly review your insurance policy to understand orthodontic benefits and medical necessity criteria. Work with an in-network provider like Dr. Leeds at Tiburon Family Dental, ensure proper documentation of medical necessity, and consider pre-authorization requirements to minimize out-of-pocket costs.